Fumiko Chino, MD, a resident in radiation oncology, last summer co-authored research showing that the high cost of cancer care is a serious problem for many patients.

Fumiko Chino, MD, a resident in radiation oncology, last summer co-authored research showing that the high cost of cancer care is a serious problem for many patients.

But for Chino, this problem—“financial toxicity”—is more than just academic.

In 2005, she was engaged to be married and was working in her dream job as an art director for a video animation company when her fiancé, Andrew Ladd, a doctoral student in robotics at Rice University, was diagnosed with neuroendocrine carcinoma, a rare cancer of the endocrine (hormonal) system cells. It quickly became clear that his student health insurance, with a $500,000 lifetime limit, was not going to come close to covering his medical bills.

“We were in our twenties, and it had never occurred to us that it might not be good insurance,” Chino says.

Ladd soon maximized his pharmacy benefits, and he and Chino had to start paying out of pocket—thousands of dollars per month—for prescription drugs that he needed daily. Chino cashed out her retirement fund. Their parents helped as much as they were able.

“We borrowed money, and we were able to pay for the medications by hook or by crook,” Chino says.

In spite of the struggles and an uncertain future, they got married as planned, and then moved in with Chino’s parents in Indiana. “We bankrupted ourselves and relied heavily on our families,” she says.

Despite their efforts, it was impossible to keep up. Hundreds of thousands of dollars in bills accumulated. Debt collectors began to call. “It was like a dark cloud hanging over us,” says Chino.

In the end, the treatments those bills reflected weren’t able to turn back his cancer. On March 4, 2007, Ladd died.

Her husband’s death redirected Chino’s life. Leaving video production behind and instead setting her sights on working for positive changes in health care, she enrolled at Duke University School of Medicine.

Chino initially intended to study geriatrics. Then she heard Yousuf Zafar, MD, a medical oncologist at Duke Cancer Institute and an associate professor of medicine, give a talk about financial toxicity—the effects of health care costs on cancer patients’ quality of life and care. She and Ladd had lived the very scenario Zafar described.

“It was a light bulb moment for me,” she says. “I knew that I’ll be passionate about cancer care and that I can actually make a change.”

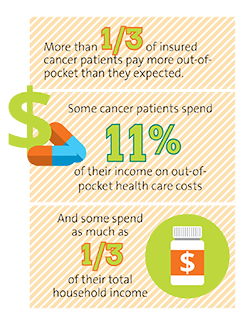

Last summer, Chino and Zafar published a study in JAMA Oncology indicating that more than a third of insured cancer patients pay more out-of-pocket than they expected, despite having health coverage. Costs such as copayments and deductibles can lead to financial distress among patients, even those with insurance, of all income levels. On average, Chino and Zafar found, cancer patients spend 11 percent of their income on out-of-pocket health care costs, and some spend as much as one-third of their total household income.

Last summer, Chino and Zafar published a study in JAMA Oncology indicating that more than a third of insured cancer patients pay more out-of-pocket than they expected, despite having health coverage. Costs such as copayments and deductibles can lead to financial distress among patients, even those with insurance, of all income levels. On average, Chino and Zafar found, cancer patients spend 11 percent of their income on out-of-pocket health care costs, and some spend as much as one-third of their total household income.

That often forces difficult decisions, sometimes with serious medical consequences. Chino has seen patients who abandon or skip medications and treatments because they cannot afford them. “I had a patient who told me, ‘I’m not willing to bankrupt my family for this,’” she says.

Chino says one part of the solution is to make conversations about costs a routine part of patient care. She talks with her own patients about the costs of treatment, and if she knows that they cannot afford a particular medication, she might be able to prescribe a cheaper one that won’t compromise their treatment.

“If you don’t think about the whole picture for cancer patients, you are missing out the best way of treating them,” she says. “We have all these great technologies and medicines like immunotherapy, radiation, and other techniques to target tumors, but all of that could fall apart if patients can't afford the gas to come to their treatment."

By Aliza Inbari

September 5, 2018

“I knew that I’ll be passionate about cancer care and that I can actually make a change.”